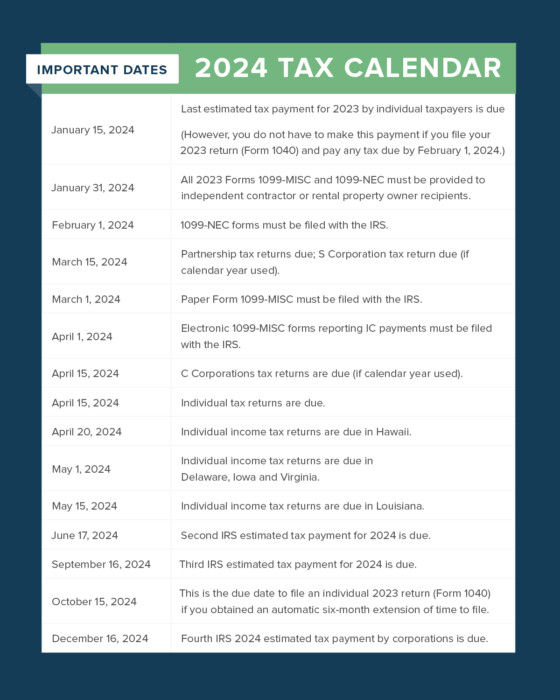

Irs 2024 Schedule C – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The IRS has announced its 2024 inflation adjustments. And while U.S. income tax rates will remain the same during the next two tax years, the tax brackets—the buckets of income that are taxed at .

Irs 2024 Schedule C

Source : carta.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

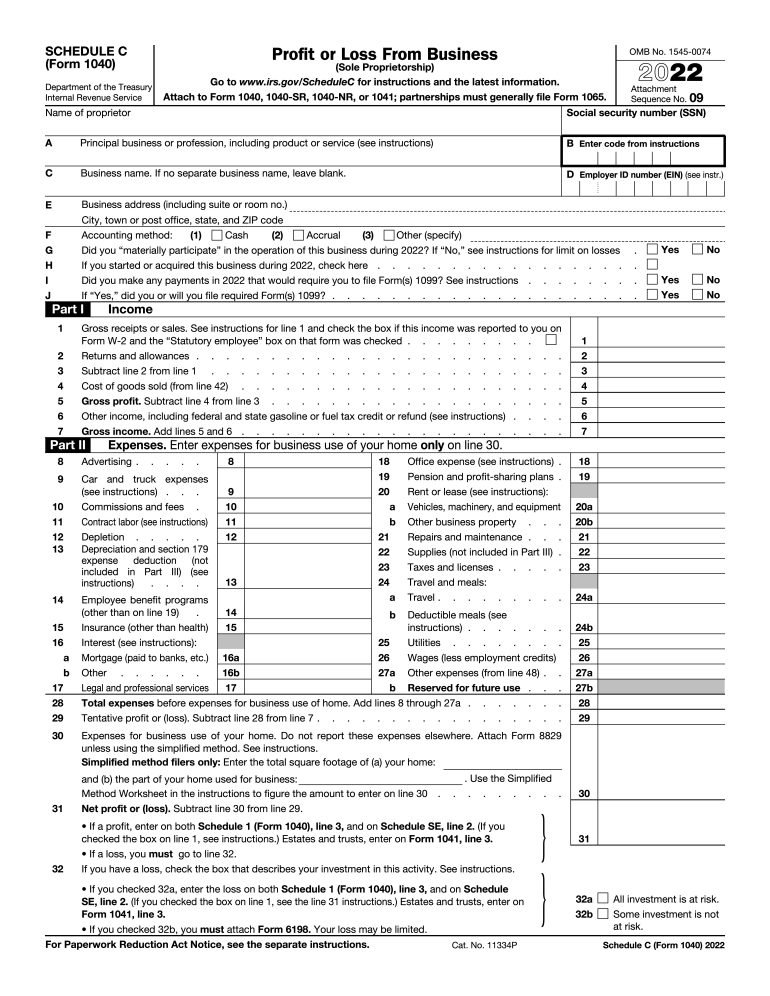

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Here’s who qualifies for IRS’ free ‘Direct File’ pilot program in 2024

Source : www.cnbc.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

BSB Associates | Hauppauge NY

Source : www.facebook.com

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube

Source : m.youtube.com

L&P Tax Pros

Source : m.facebook.com

IRS Schedule LEP Walkthrough (Request for Change in Language

Source : www.youtube.com

Irs 2024 Schedule C Business tax deadlines 2024: Corporations and LLCs | Carta: That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer . The IRS revealed updated federal income tax brackets and standard deductions for the upcoming tax year 2024, affecting returns filed in 2025. The adjustments, unveiled on Thursday, showcase .