Irs Payment Schedule 2024 – The Internal Revenue Service (IRS) has revealed new income tax rates for the year 2024, with substantial ramifications for taxpayers. This update affects the way individuals and families will be taxed . There are seven tax brackets for most ordinary income for the 2023 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. .

Irs Payment Schedule 2024

Source : thecollegeinvestor.com

SSI Payment Schedule 2024 Stimulus Checks Dates, How to Apply for

Source : www.incometaxgujarat.org

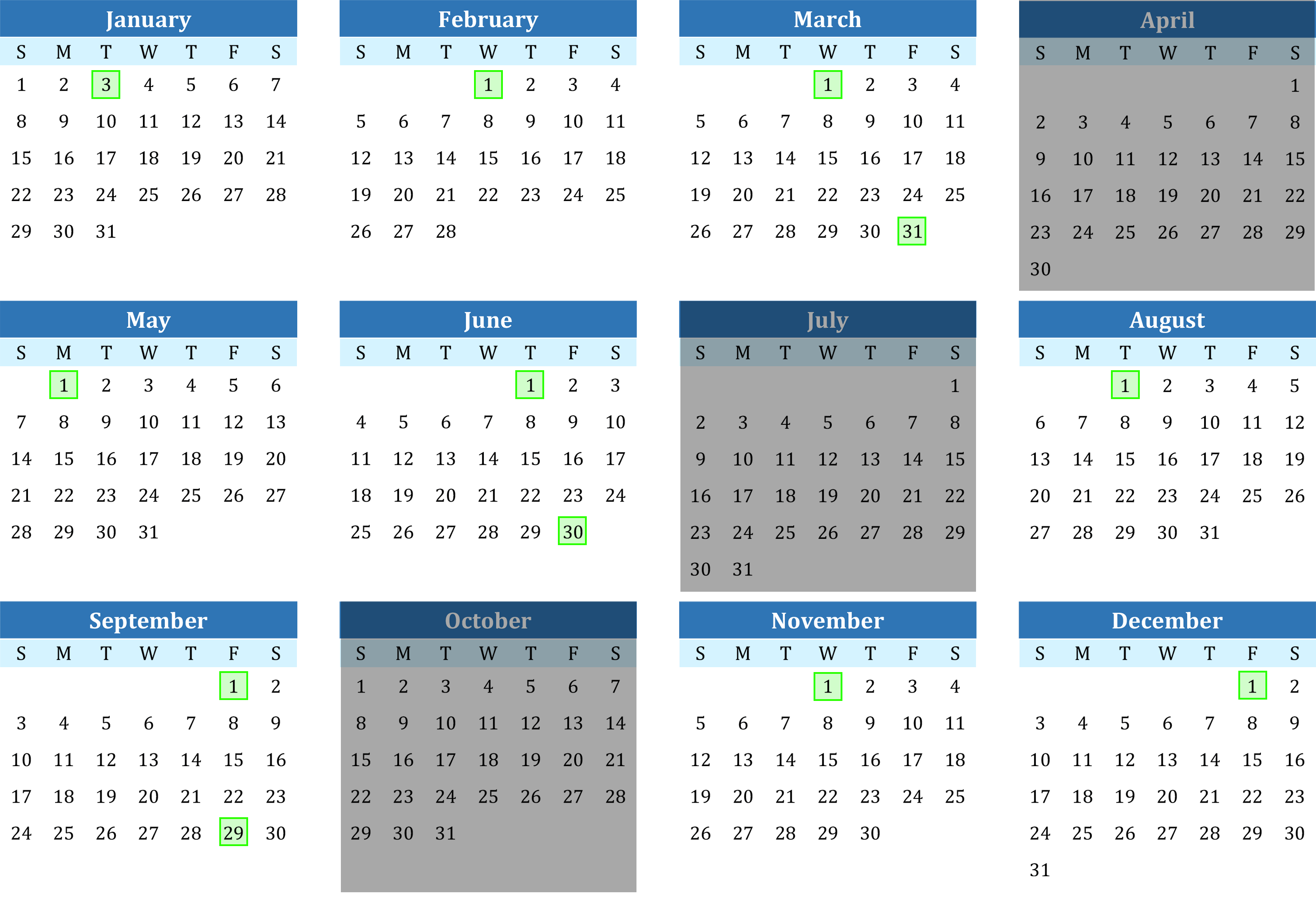

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

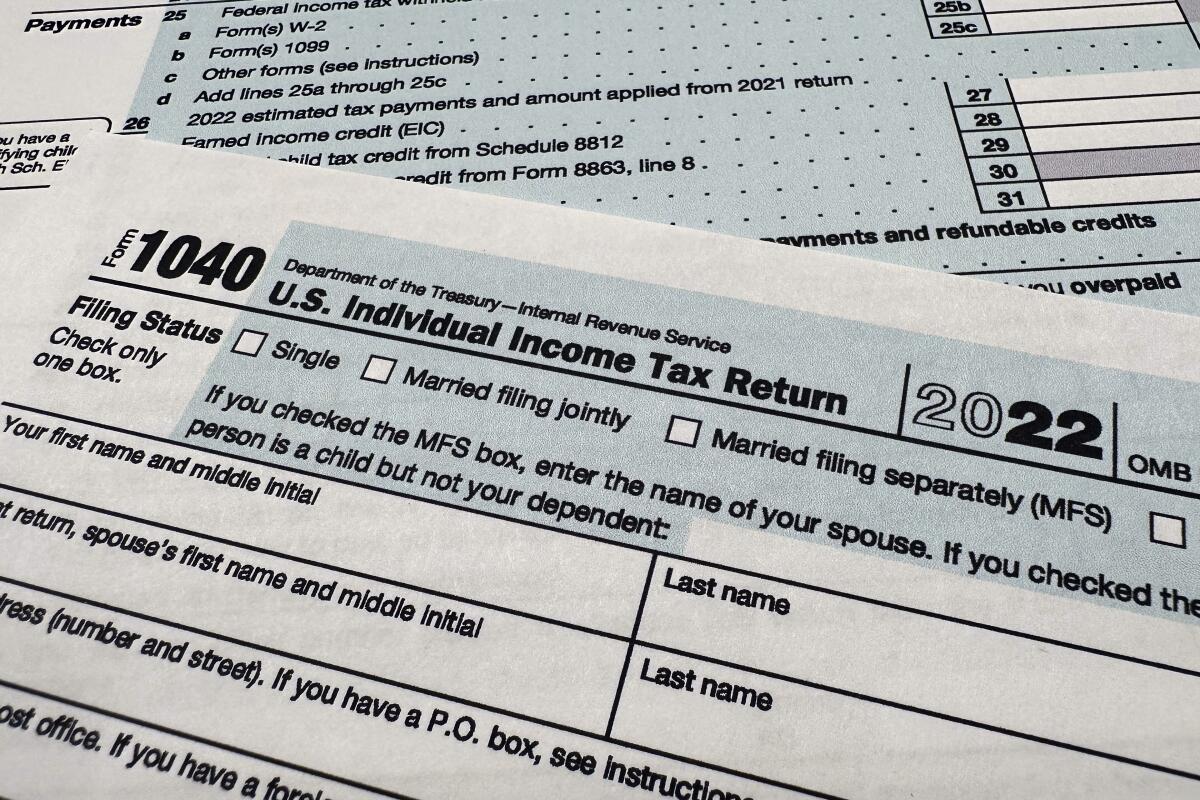

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

OPERS Get Ready for 2023

Source : www.opers.org

3.30.123 Processing Timeliness: Cycles, Criteria and Critical

Source : www.irs.gov

Morales United Tax Services / Lunaz Multiservices | Houston TX

Source : www.facebook.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com

Irs Payment Schedule 2024 When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: The Internal Revenue Service announced on Thursday that the thresholds for income tax brackets, and the standard amount Americans can deduct, are both moving up. The moves — two among several . A lot of us don’t really think about taxes until the time comes to file a return. But it’s important to have a pulse on your tax situation at all times. And part of that means knowing what tax bracket .